social security tax rate

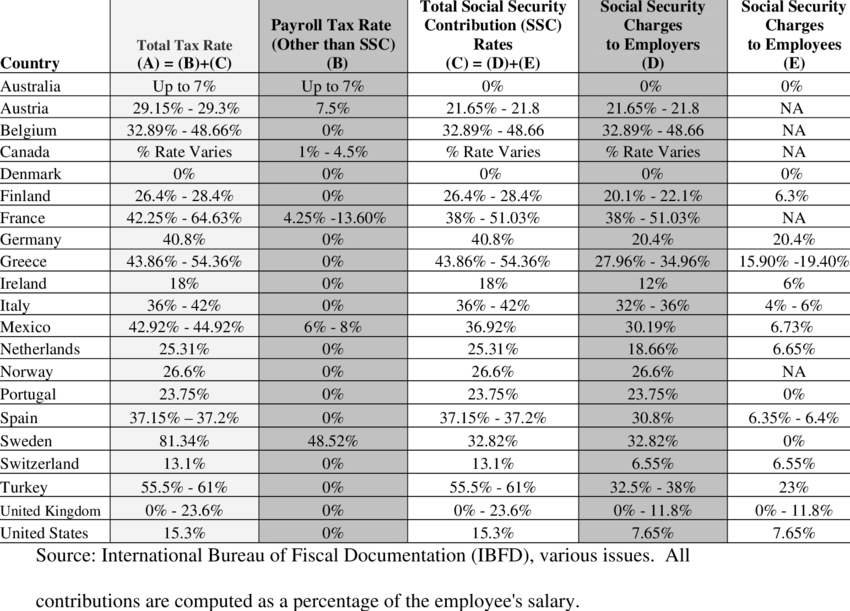

The tax rate for 2022 earnings sits at 62 each for employees and employers. A Social Security tax is the tax levied on both employers and employees to fund the Social Security program.

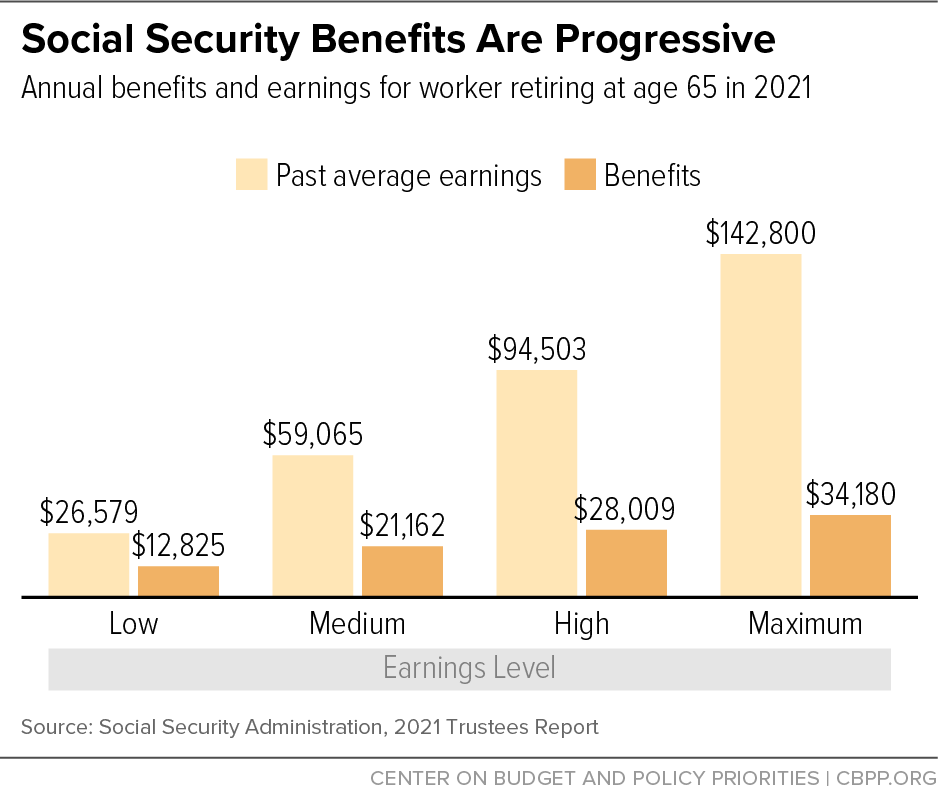

Policy Basics Top Ten Facts About Social Security Center On Budget And Policy Priorities

Social Security Tax.

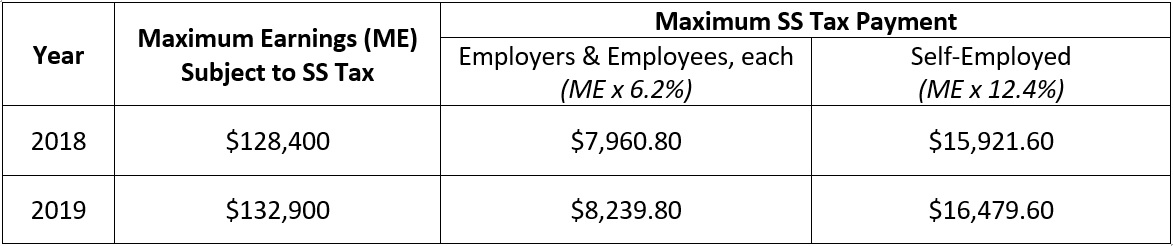

. There is a limit on the amount of annual wages or earned income subject to taxation called a. Social Security tax is usually collected in the. As a result the maximum Social Security tax possible jumps from 9114 to 9932.

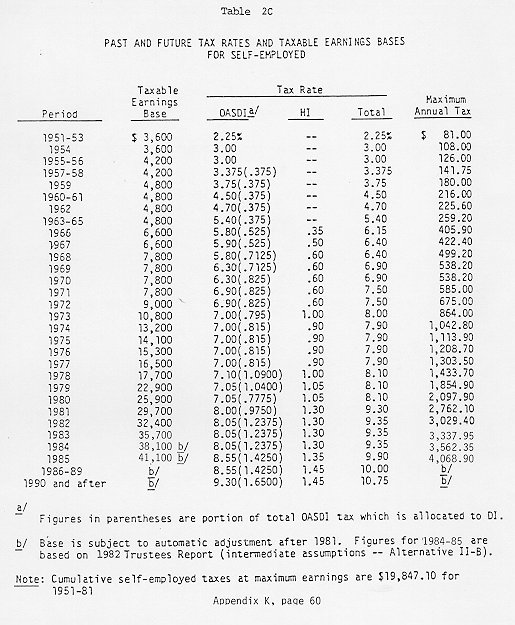

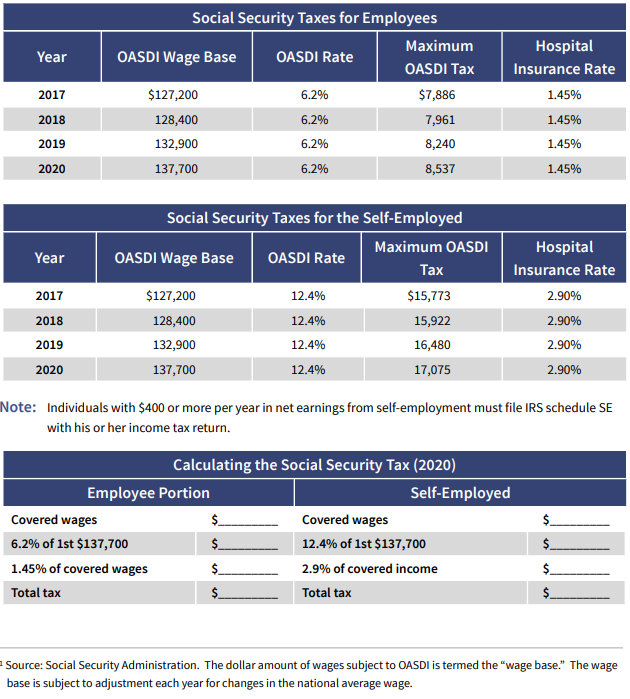

However unlike the tax rate the Social Security tax limit is adjusted annually. Social Security and Medicare Withholding Rates. The Social Security tax rate rarely changesemployees have been paying 62 since 1990.

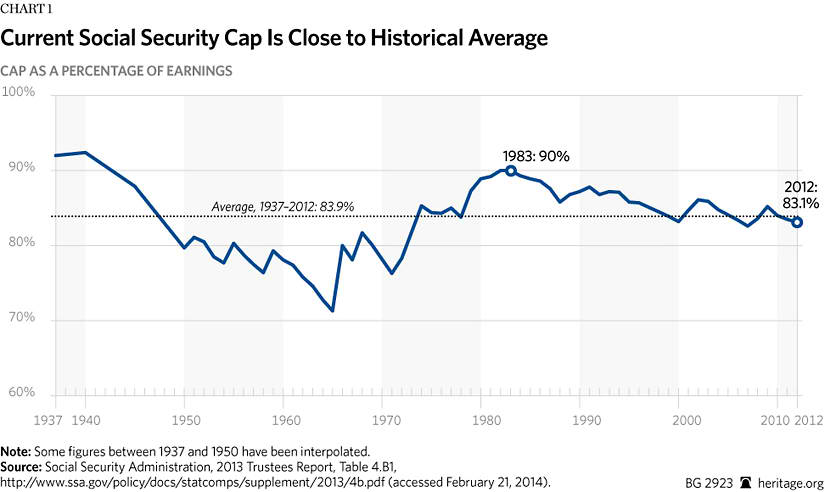

Between 25000 and 34000 you may have to pay income tax on. Social Security functions much like a flat tax. Social Security tax For 2016 the wage base is 118500 and this number can rise annually along with national wage growth.

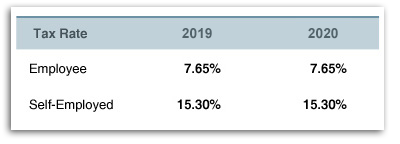

The current tax rate for social security is 62 for the employer and 62 for the employee or 124 total. The Social Security tax rate for those who are self-employed is the full 124. Everyone pays the same rate regardless of how much they earn until they hit the ceiling.

Currently many retirees pay taxes on their Social Security benefits. The current rate for. West Virginia passed a law in 2019 to begin phasing out taxes on Social Security for those with incomes not exceeding 50000 single filers or 100000 married filing jointly.

So individuals earning 147000 or more in 2022 would contribute 9114 to the OASDI program. A new bill though would get rid of those taxes and make up for the revenue by raising the cap on payroll. You will pay tax on only 85 percent of your Social Security benefits based on Internal Revenue Service IRS rules.

As of 2021 a single rate of 124 is. In addition unlike federal income tax no deductions. Fifty percent of a taxpayers benefits may be taxable if they are.

These rates have been. In 2015 the tax rate for Social Security was 62 of an employees income for the employee and employer each or 124 for self-employed workers. So for people making over 160200 in 2023 they will be paying 818 more in Social.

Filing single single head of household or qualifying widow or widower with 25000 to 34000 income. 35 rows For 2011 and 2012 the OASDI tax rate is reduced by 2 percentage points for. However if youre married and file separately youll likely have to pay taxes on your Social Security income.

The 2022 limit for joint filers is 32000.

National Burden Taxes And Social Security Contributions In Japan Exceed 40 Of Income For Ninth Consecutive Year Nippon Com

Distributional Effects Of Raising The Social Security Payroll Tax

Social Security And Medicare How Are Payroll Taxes Calculated Zenefits

Done By Forty Our Truly Regressive Tax Social Security

Social Security Programs Rates Limits Updated For 2019 Scott Company Columbia Sc Accounting Firm South Carolina Cpa

Tax Rates From Payroll Taxes And Social Security Contributions In Oecd Download Table

Saving Social Security General Revenue To The Rescue Concord Coalition

How Often Does Social Security Tax Increase Year By Year Breakdown

Historical Social Security And Fica Tax Rates For A Family Of Four Tax Policy Center

Increasing Payroll Taxes Would Strengthen Social Security Center On Budget And Policy Priorities

Social Security And Taxes Could There Be A Tax Torpedo In Your Future

United States Social Security Rate For Companies 2022 Data 2023 Forecast

Raising The Social Security Payroll Tax Cap Solving Nothing Harming Much The Heritage Foundation

Soical Security And Medicare Taxes

Research Income Taxes On Social Security Benefits

United States Social Security Rate 2022 Data 2023 Forecast 1981 2021 Historical