open end lease accounting

Short-term leases contract term is for twelve months or less including options to extend will continue to be. Schedule A Free Demo With The 1 Rated Lease Accounting Software - LeaseQuery.

Lessee Accounting For Governments An In Depth Look Journal Of Accountancy

The open-end finance lease which in most cases has either an addendum or a modification to the contract changing it to an operating lease for accounting purposes.

. In a closed-end lease the lessor takes on the depreciation risk. Monthly payment amounts vary usually stepping down year-over-year as. BUS 109 Management Theory and Practices and Practices.

Ad Ensure Lease Accounting Compliance with Visual Leases Lease Accounting Software. Ad Boost Accuracy Timeliness of Your Expense Processes. Medford Logistics Center at 645 National Boulevard is a proposed 129242-square-foot industrial building ideally located off a signalized intersection on Sills Road in Medford New.

Ad Get Products For Your Accounting Software Needs. Open-end leases are generally blanket or master leases with multiple takedowns of equipment. Outsource CAM audit services prevent overcharges minimize risk of slippage.

Schedule A Free Demo With The 1 Rated Lease Accounting Software - LeaseQuery. An open-end lease has more flexible terms and the lessee takes on the depreciation risk of the asset. Available office spaces in Medford MA range in size from 2890 square feet to 25019 square feet.

Mendelsohn CPA is a Long Island CPA firm offering a variety of outsourced accounting and outsourced bookkeeping services like payroll financial statements and tax planning. The Solution To The Challenges Of Day-To-Day Application Issues. Ad Schedule a Free Demo with the Lease Accounting Experts at LeaseQuery.

These listings include 9 office spaces that encompass a total of 94739 square feet. Organized Accessible From Any Device. BUS 101 Accounting I.

Ad Leverage professional CAM audit services to ensure accuracy of charges maximum recovery. Ad Schedule a Free Demo with the Lease Accounting Experts at LeaseQuery. A lease is an arrangement under which a lessor agrees to allow a lessee to control the use of identified property plant and equipment for a stated period of time in exchange for.

Centralizes Your Firms Financial Data. Rated The 1 Accounting Solution. Number of months 612 ie.

The open-end lease bill breaks down the monthly depreciation management fee interest and taxes. The present value The lease payment is 1033 which is greater than 90 of the assets fair value. QuickBooks Financial Software For Businesses.

Manage Your Entire Lease Portfolio And Stay Compliant With Lease Accounting Software. Ad The Complete Legal Accounting Software Available Across All Your Devices. Therefore its a capital lease.

In an open-end lease subject to the three-payment rule you are responsible for any difference if the actual value of the vehicle at scheduled termination is less than the. O Contact legal counsel and explain the new terms for accounting purposes. They normally involve portable or mobile equipment that is clearly not special purpose to the.

BUS 102 Accounting II. Ad Explore Accounting Tools Other Technology Users Swear By - Start Now. Ad KPMG Explains The New Leases Standard In Detail With QAs Examples And Observations.

Lease Accounting Calculations And Changes Netsuite

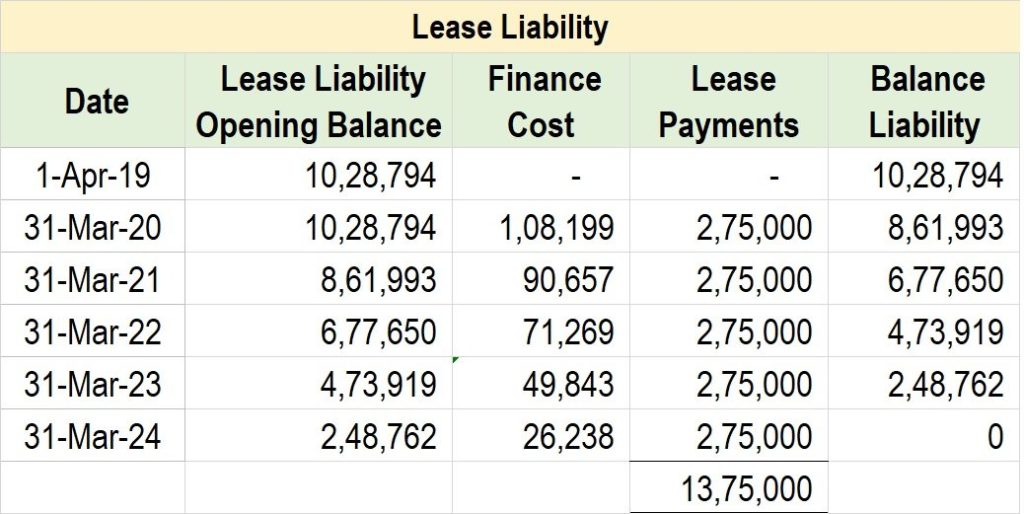

Lease Accounting Treatment By Lessee Lessor Books Ifrs Us Gaap

Ifrs 16 Leases Summary Example Entries And Disclosures

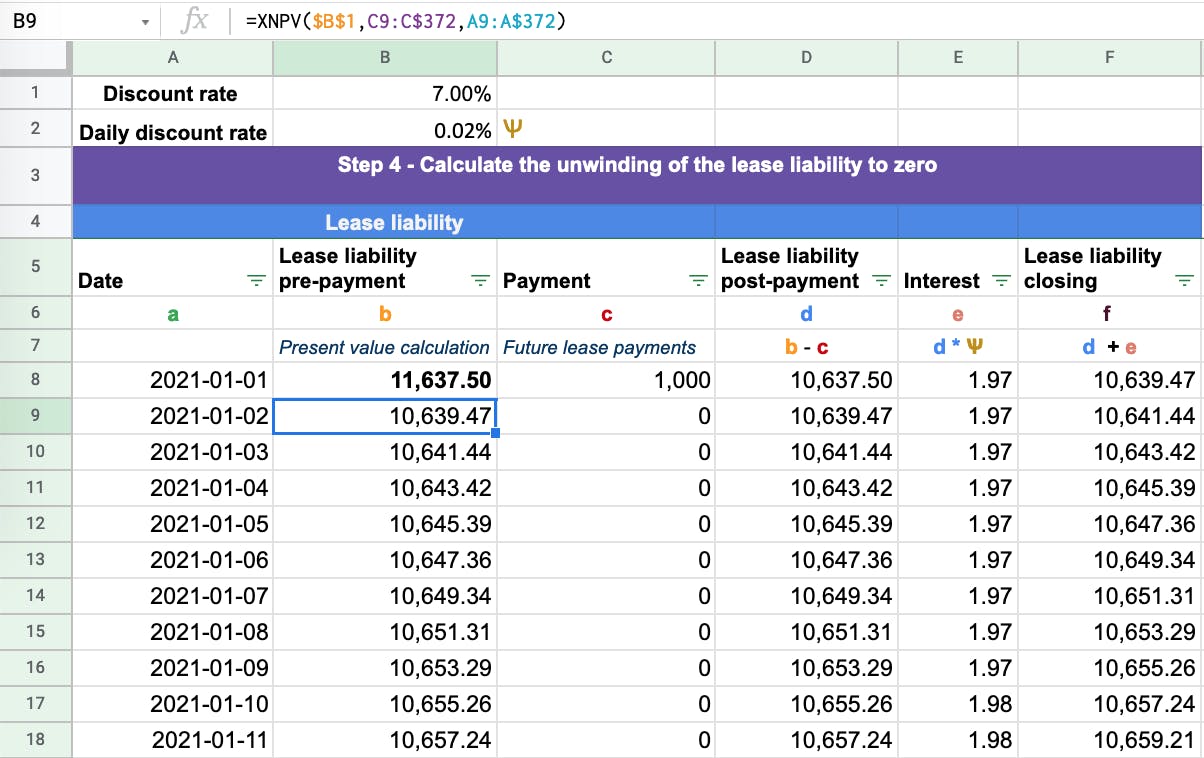

How To Calculate A Lease Liability And Right Of Use Asset Under Ifrs 16

Accounting For Leases The Marquee Group

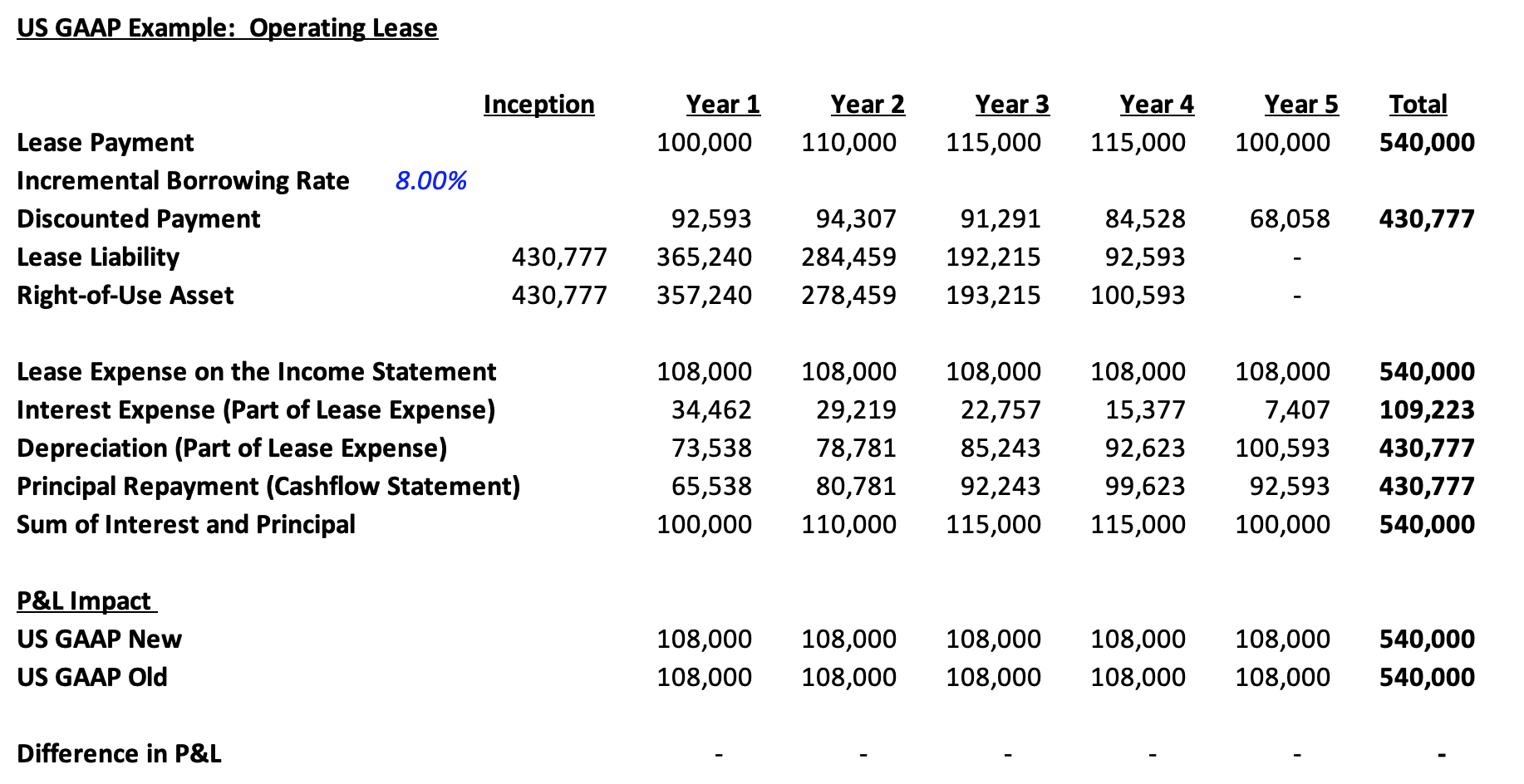

Lease Accounting Operating Vs Financing Leases Examples

Lessee Accounting For Governments An In Depth Look Journal Of Accountancy

Open Vs Closed End Leases What To Know Credit Karma

Lessee Accounting For Governments An In Depth Look Journal Of Accountancy

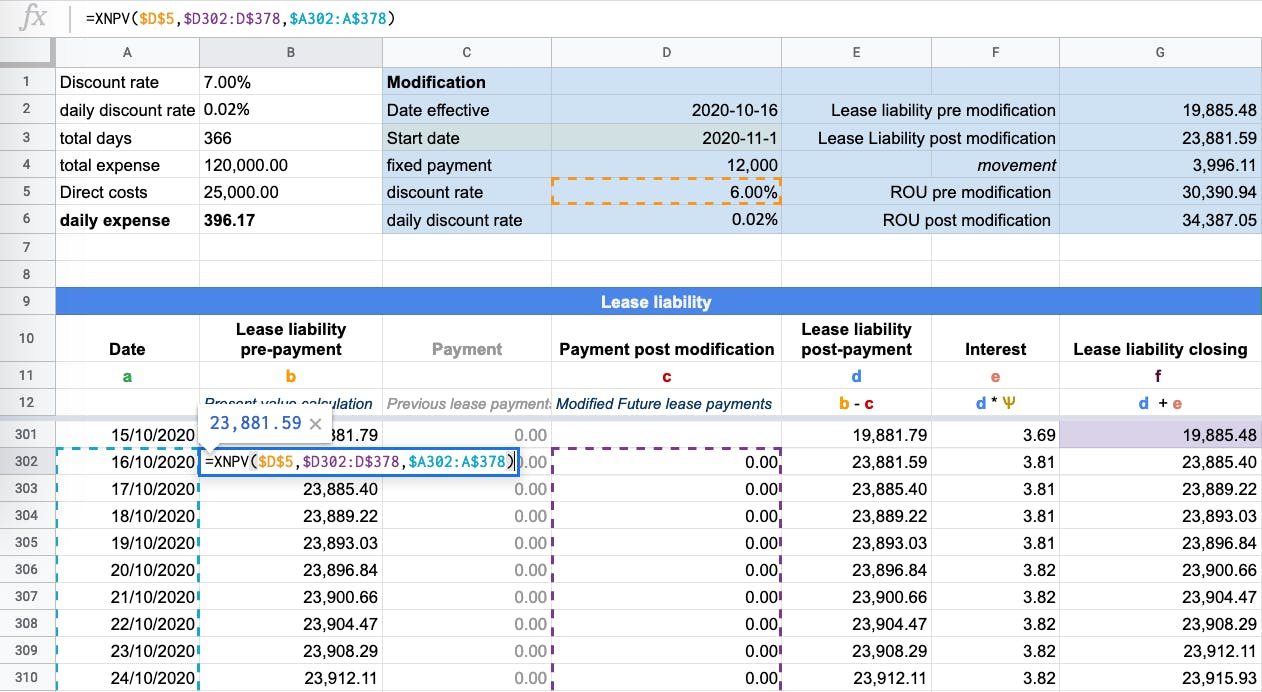

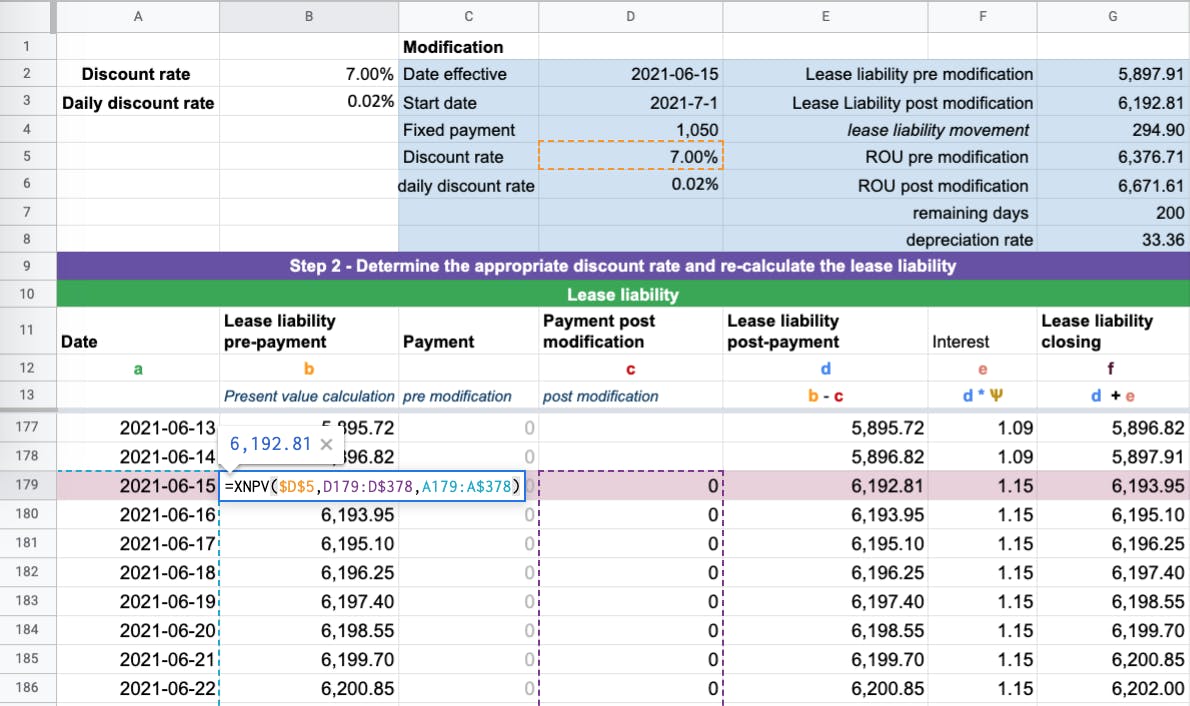

5 6 Accounting For A Lease Modification Lessor

Lessee Accounting For Governments An In Depth Look Journal Of Accountancy

Lease Accounting Journal Entries For Modification

Accounting For Leases The Marquee Group

How To Calculate The Lease Liability And Right Of Use Rou Asset For An Operating Lease Under Asc 842

How To Calculate The Journal Entries For An Operating Lease Under Asc 842

How To Calculate The Lease Liability And Right Of Use Rou Asset For An Operating Lease Under Asc 842

Lessee Accounting For Governments An In Depth Look Journal Of Accountancy

How To Calculate A Lease Liability And Right Of Use Asset Under Ifrs 16